What is appraisal?

Appraisal is the process of evaluating business functions and activities to ascertain:

- which records need to be created and captured

- how long the records need to be kept to meet business needs, organisational accountability and community expectations[1].

[1] adapted from Bettington, J. et al. (eds) 2008, Keeping archives, 3rd edn, Australian Society of Archivists, Canberra, pp. 11-28.

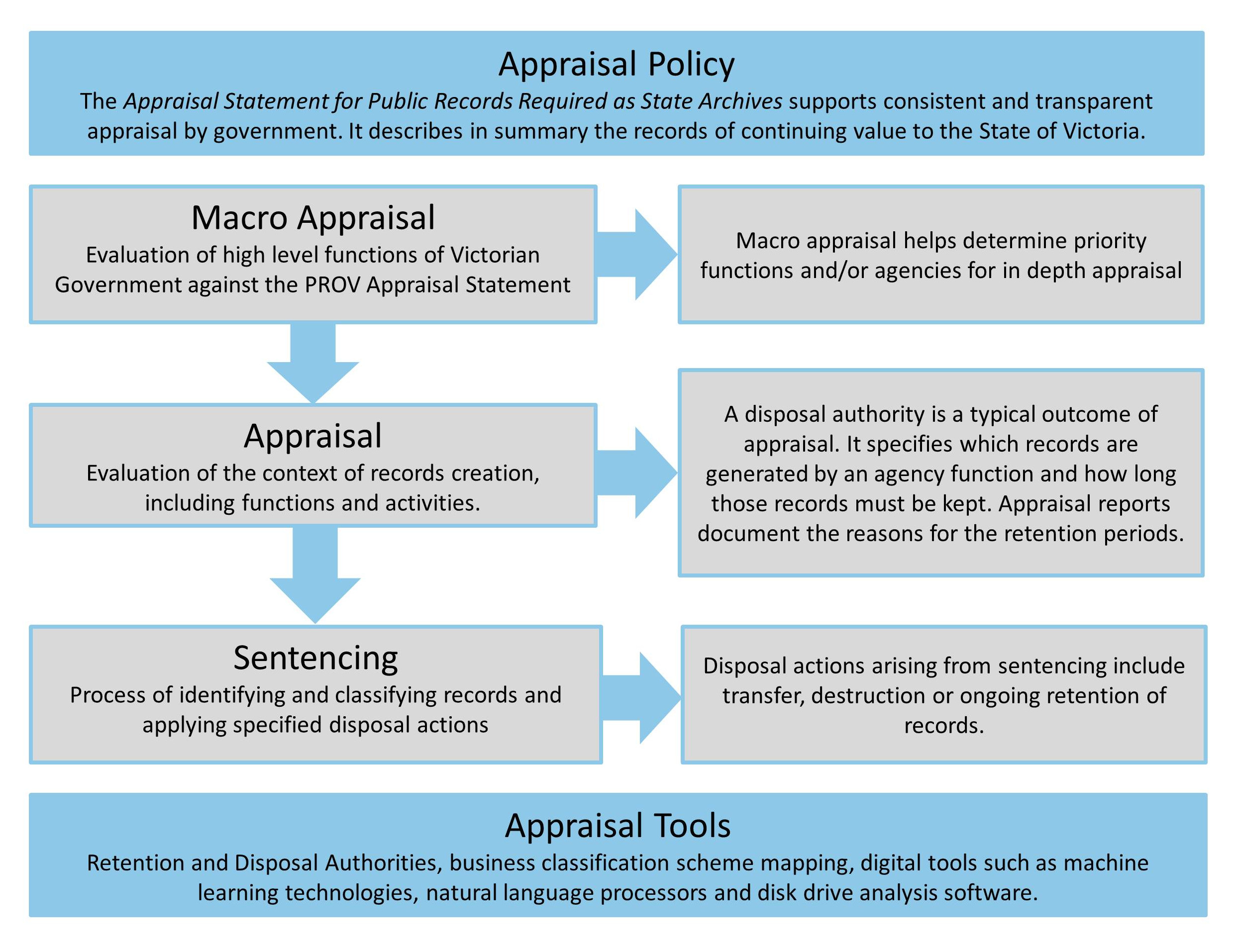

PROV appraisal framework

Public Record Office Victoria’s (PROV’s) current work in appraisal is consistent with modern Australian practice—emphasising the contextual value of records through the evaluation of functions and activities, rather than the records themselves.

Appraisal decisions regarding Victorian Government records are specified in:

- Appraisal Statement for Public Records required as State Archives Policy

- Retention and Disposal Authorities (RDAs)

- Summary Appraisal Reports:

Appraisal to determine retention requirements

In general, records can be appraised to have either:

- Continuing value/permanent value as State Archives, or

- Temporary value, i.e. records are required only for a specified period of time.

Below is an outline of the approach to appraisal for specifying and identifying records' retention periods for both business needs and for continuing value as State Archives.

|

Understanding and applying appraisal criteria is essential to:

|